LLCs For Online Businesses

Many businesses these days operate solely online and do not sell through physical premises. So, if you are the owner of this type of business, you may well have asked yourself the question, “am I required to establish an LLC for an online business?”

The answer is no, an LLC is not required to start an online business, but it is often recommended if you are interested in adding some limited liability protection for personal assets.

If this is a question you’ve already asked yourself, then you have probably searched for the answer online already. Incfile has a great article; If You’re a Blogger, Do You Need To Form An LLC? There is an ocean of information on the internet about forming an LLC for a new business, but navigating your way to the right solution can be difficult as there is so much information available.

If this is a question you’ve already asked yourself, then you have probably searched for the answer online already. Incfile has a great article; If You’re a Blogger, Do You Need To Form An LLC? There is an ocean of information on the internet about forming an LLC for a new business, but navigating your way to the right solution can be difficult as there is so much information available.

You can form an LLC by yourself online, hire an attorney to assist you, or use an LLC service to guide you through the process.

In this article, we will consolidate the key information that you need so you can answer questions like:

- Do I need to form an LLC?

- What is the scale of risk that my business faces?

- What expenses are involved in forming an LLC?

Background on Limited Liability Companies

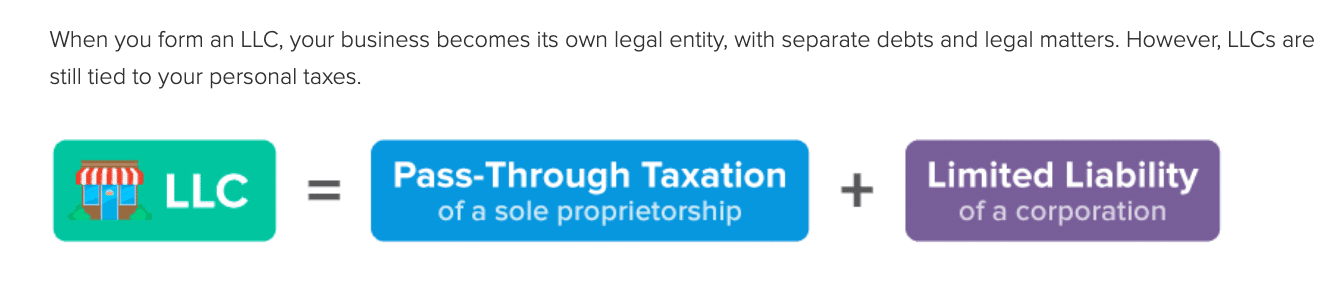

Limited Liability Companies, or LLCs for short, are the most basic business entity structure available for sole entrepreneurs and online business owners. An LLC’s tax implications are not so complex as it is for a corporation, although they still benefit from many of the legal aspects enjoyed by larger entities.

Many business owners do not even consider forming an LLC, as they feel that a sole proprietorship is the only entity type suitable for their business. Freelancers are prime examples for people who think this way, as a sole proprietorship is viewed as the most natural path.

If your business involves dealing with clients on a one-to-one basis, or it has a substantial database of customer details, or if you are selling your own e-product or service, then it might be time to get a little more formalized in business terms.

Do you need to form an LLC?

Incfile is one of the leading LLC formation services in the U.S., and their website discusses the benefits and disadvantages of forming an LLC.

From the Incfile website,

Benefits of Starting an LLC

- Limited Liability Protection By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the business — not the members. The members liability is limited to the personal interest they have invested in the company thus protecting the personal assets of the individual member that are separate from the LLC.

- Pass Through Taxation The LLC typically does not pay taxes for itself. Instead, the net income/loss is “passed through” to the personal income of the owner(s)/member(s), and is simply taxed as personal income. Federally, LLC taxation is handled very much the same as a partnership or sole proprietorship, in the case of a single member LLC.

Disadvantages of LLCs

- Self Employment Taxes Although we listed Pass Through Taxation as an LLC benefit, it can also be a disadvantage. Oftentimes the taxes that are passed through and reported as personal income of LLC members will be higher than the taxes at a corporate level. You will also still pay for federal inclusions such as Medicare and Social Security. If you’re confused if this business structure will be the right tax choice for you, it’s a good idea to speak to your accountant or financial advisor.

- Careful Personal Records As the owner of an LLC, you need to keep careful records of your business expenses — separate from your personal finances. This is the only way to ensure limited liability. Therefore, you should have separate bank accounts and cards to track business expenses.

3 Reasons why people consider forming an LLC

- Your business is already established, and you have existing customers.

- You want to protect your private assets from risks associated with your business.

- Your business has multiple owners or partners.

If the conditions summarized apply to your situation, we not only recommend that you establish an LLC but that you get some professional advice on which particular business entity type you should establish.

Once you have determined the entity best suited to your business, we have separate articles that will provide you with advice on filing an LLC, as well as tax filing.

What is the scale of risk that your business faces?

Risk is one of the main reasons for establishing an LLC

Business and company owners who want to protect themselves from the risks associated with their business use the LLC entity to protect themselves and limit their exposure to legal action against the firm.

Even with a part-time side hustle going on to supplement your primary income, you should seriously consider forming an LLC. Sellers of electronic information products via the internet are particularly vulnerable to litigation from customers who feel they’ve received poor advice.

Regardless of your business, if your sales and revenue are increasing, so too is your risk of litigation from one of your customers. Certainly, when you believe the risk of your business getting involved in a legal dispute is anything other than low, form an LLC to protect against that risk.

Don’t worry if you’ve already started running your online business. Forming an LLC for an ongoing business is straightforward and will mitigate your legal risks considerably.

Points to Clarify

While delving into the plethora of existing online information regarding LLCs, we noticed that there are a couple of issues that could cause some confusion to those considering forming an LLC. In the next few paragraphs, we’ll clarify these for you:

-

What protection do you get from an LLC?

When you form an LLC, you and your business will be considered separate entities as far as the law is concerned. Your business will have its own bank account, its own assets, property, etc.

It also means that it could be liable to be sued in the event of a dispute or that it could issue a lawsuit against another party.

The key aspect is that the LLC would have legal action against it and not you as the owner who will face legal action and its consequences.

Take the situation where you have sold an electronic information product, and the advice contained within it has led to injury or illness. There could be individual or group legal action taken against the business that provided that product.

If your business is an LLC, you, as an individual, along with any business partners you have, are protected. The lawsuit can result in the LLC losing its assets, but your personal assets cannot be touched because you and the LLC are considered separate entities.

Of course, this does not protect you if you, personally, have been responsible for causing injury or loss. You can also still be held to account for any loans you have taken out for your business in your name.

Neither does an LLC protect you if you fail to pay taxes or employees’ salaries.

And, of course, it will not protect you from the legal consequences of any illegal activities. Everyone’s situation is unique, and you should discuss your situation with a business lawyer to ensure you receive the best advice.

The bottom line is that an LLC will provide you with considerable benefits in terms of protection, but that it does not cover you for being negligent or doing something illegal.

Importantly, an LLC needs to be in place before an event that brings legal action; you cannot form an LLC to get protection retrospectively.

Consider your LLC to be a protective layer rather than a guardian angel. You can also augment the protection you get from an LLC with liability insurance. Depending on the size of your online business and the types of products or services you are offering, you can choose an appropriate level of cover.

-

What are the potential benefits of an LLC?

We’ve already covered the benefit of personal protection from liability, but there are other advantages to forming an LLC too.

An LLC will give you a more formalized business structure, which can prove incredibly beneficial if or when you have partners. Being structured as an LLC will help you when people join and leave the business and when and how to pay out dividends or profits to staff or partners.

Taxation is another area where an LLC can be affected, as you will be taxed as a corporation. To optimize your tax, you should consult an accountant as it is beyond the scope of this article.

Cost of Forming an LLC

It is relatively inexpensive to form an LLC for your online business, and you can do it straight away at ZenBusiness for around $49.

For $199 + state fee and ZenBusiness gives you one year of registered agent services.

Even though you are an online business, you will still need to pay state fees, which vary depending on the physical location of your business.

So, it is worth checking out your state’s LLC filing costs online before you start the process.

How do you form an LLC?

Numerous companies are offering LLC-forming services online; LegalZoom is one of them that we have experience with. As with most things, there is a do-it-yourself route for forming an LLC, and if this option is the one you choose, be sure to check out your state’s filing instructions.

The filing part is generally straightforward; learning to run your business as a separate entity might take some getting used to.

You will need to separate your finances from those of the company; separate bank account, separate credit cards, separate expenses, etc. If you have been a sole proprietor for a while, this separation may take some time for you to become comfortable with.

There are plenty of online articles to help you adjust.

Filing an LLC if You Are Employed

You may be in full-time employment and have a small business running as a side hustle. This is generally fine, and you can still form that business as an LLC, depending upon your state’s regulations. If you’re using LegalZoom, they have no restrictions on employees filing for an LLC.

You should, of course, check your employment contract before forming your LLC, as there may be a clause within the contract that prevents you from doing so. If in doubt, you should first check with your boss or your HR department.

If interested in forming an LLC for an online business, visit Incfile; they have very reasonable prices.

Business owners should check out this list of the best places to order business checks online for additional products and services.

The information contained on this page and this website are for general information and educational purposes only. It is not intended to offer legal advice. If you need legal advice, you should consult with an attorney.