If you are looking to create an LLC in Wyoming and would like assistance with the formation process, we have listed our top 5 favorite picks for Wyoming’s best LLC formation service.

LLCs have become a prevalent type of business entity. There are many ways to create one.

- You could create an LLC by yourself using the DIY method, and it may not be that easy if you have never done it before.

- You can hire an attorney to create your LLC; this option is expensive and unavailable for many startups.

- Or you can hire an online LLC service to assist you with the process.

While there are many trusted LLC services online today, these five services stand out for Wyoming. Let’s talk about which LLC service is best for your business formation.

We’ve compared the top LLC formation services and provided a comparison of their pricing and features.

We evaluated the BBB ratings and reviews from a list of 23 LLC services, including the complaints from each company.

Other benchmarks include pricing, formation process time, return customers, and customer service and support.

If you want to start a business anywhere in Wyoming, these LLC services can assist you with the business filing and formation process.

#5 Rocket Lawyer

- LLC Formation and Incorporation Services

- Great For Business Formations & Ongoing Legal Services

- Free 7-Day Trial With One Free LLC Formation Filing Application

- For Non-Memberships, LLC formation Starts at $99. + state fee

- Legal Plan Subscriptions, $39.99/mo Premium Plan + state fee

- Registered Agent Services

#4 Swyft Filings

![]()

- LLC Formation, Incorporation, and Registered Agent Service

- Lifetime Customer Support

- Real-Time Online Order Status Tracking

- Dedicated account to access all of your documents

- Free Shipping on All Orders

- Money-Back Guarantee

Check for current pricing

#3 ZenBusiness

- Over 100,000+ Businesses Formed In The Last Year!

- The Starter Plan is $49 + state fee and includes state filing, Articles of Organization, formation in about 1-3 weeks!

- The Pro Plan is $199 + state fee, everything in the Starter Plan, formation done in 4-6 business days and this an Employer ID Number (EIN)

- The Premium Plan is $299 + state fee, everything in the Pro Plan, formation in about 1-3 business days, business website, domain, and email.

- Registered Agent Service is $99/yr

#2 Incfile (Editor’s Choice)

LLC Formation and Incorporation Services

500,000+ Business Formations Since 2004

Texas Company

$149 + state fee

Business formation includes,

- Preparing and filing articles of organization

- FREE registered agent service 1st year

- EIN business tax number

- Operating agreement

- Banking resolution

- Free Registered Agent Service (1st Year)

#1 Northwest Registered Agent (Editor’s Choice)

Northwest Registered Agent

Formation with Registered Agent Service $225 $39Discounted Just $39

The Leader In Business Formations and Registered Agent Services

- LLC Formation and Incorporation Services

- Privacy by Default

- LLC Pricing Starts at $100.00 + state fee

- Most Popular Plan $225 + state fee

- Monthly Plans Available

- Strong customer service, direct phone line, and same-day email response

Monthly Plans Available (‘Skip The State Fee’)

$37 Gets You Out The Door With A Newly Formed Business in California or Georgia! ?

- California LLC $37/mo

- Texas LLC $54/mo

- Georgia LLC $37/mo

Northwest Registered Agent $39

Comparison Table: Prices for their Popular LLC Formation Plans With One Year of Registered Agent Service

| Northwest Registered Agent Editor’s Choice! |

|

| Incfile | $149 |

| ZenBusiness | $299 |

| Swyft Filings | $299 |

| Rocket Lawyer | $250 |

How To Form An LLC

9 Steps To Create An LLC

Step 1: Select a State

Step 2: Choose a Name For Your LLC

Step 3: Choose a Registered Agent

Step 4: Prepare An LLC Operating Agreement

Step 5: File Organizational Paperwork With the State

Step 6: Obtain a Certificate From the State

Step 7: Obtain an EIN (Employer Identification Number)

Step 8: Obtain a Business Bank Account

Step 9: Register To Do Business in the Other States (Optional)

What Is An LLC Operating Agreement?

An LLC Operating Agreement allows owners to structure working and financial relationships between co-owners to suit the business.

In an operating agreement, the co-owners should establish each owner’s ownership percentage share in the LLC, their share of profits, their responsibilities and rights, and how an owner leaving will be handled.

The ZenBusiness website explains it this way,

What is an operating agreement and why do I need one?An operating agreement is a document that protects the owner’s personal assets from the actions of the LLC, clearly outlines which actions are acceptable for the business, and creates a succession plan should the owner exit the business.You have full control over how to write your operating agreement, but it’s important to follow standard formats to ensure you protect your interests and support your company as it grows.

Additional benefits of an LLC operating agreement

Avoids some of the default rules of the state where you form your LLCWithout an operating agreement, your LLC will default to some of the standard rules and guidelines set by the state.

Helps secure funding from investors and lendersOperating agreements outline legal and financial details like decision-making authority and how funds are used that can be helpful when trying to secure funding for your business.

LLCs & FAQs

What is A Single-Member LLC?

Single-member LLCs are a viable alternative to establishing your business as a sole proprietorship.

Sole proprietors only work for themselves. As a result, there aren’t any rules or fees applicable to sole proprietorships, although there are a few requirements you need to consider if you want to start hiring employees. Since the proprietor and the business are legally considered the same, such a business structure could place the proprietor’s assets at risk if the business falls into financial woes.

To counter this risk, you can set up a single-member LLC, of which you are the sole owner. This arrangement protects your personal assets in case the business goes bankrupt.

You can also add the ‘LLC’ term to the name of your business, protect your assets and limit your liabilities if the business fails to make proper payments or has a lawsuit filed against it.

However, this arrangement is not without its disadvantages. You have to register your LLC with state authorities, ensure that your business complies with applicable laws and regulations, and pay the annual LLC registration fees as well.

How Do The Owners of a Single-Member LLC Get Paid?

Owners of single-member LLCs don’t draw a salary or get paid any wages. Instead, they are entitled to withdraw the money in the LLC’s account at their discretion.

It is called ‘Owner’s draw.’ The owner of a single-member LLC can write a check for themselves or transfer money from their LLC’s account into their personal account. It’s that simple!

How Are Owners of a Single-Member LLC Taxed?

As per the IRS, a single-member LLC is treated similarly to a sole proprietorship by default. Your LLC is considered to be a ‘disregarded entity’ in the eyes of the IRS. The LLC is not required to pay any income tax. Instead, its profits & losses get passed on to the owner.

In simple terms, single-member LLC owners don’t need to file any extra federal tax returns. Since they’re the sole owner of the business, the total income earned by the LLC is treated as their income in their tax filings. However, your state might have different tax filing regulations for LLCs. Do go through your state’s laws regarding this subject.

However, owners can also opt for their LLC to get taxed like a corporation. In such cases, the owners are considered to be an employee. They can pay themselves through the LLC’s payroll if they choose to do so.

While this method will lower your self-employment taxes, you’ll also have to spend more time buried in paperwork during tax season. Therefore, we recommend that you consult your accountant to learn more about this route before you make a decision.

What Are Online Legal Services?

Online legal service platforms are modern alternatives to traditional law firms. Online legal service websites help you contact independent law practitioners who can provide you with legal services should the need arise.

In case you do not wish to engage the services of a personal attorney for your business requirements, these platforms can connect you with qualified experts who can send in your license applications, draft contracts, or submit important documents without charging the exorbitant fees or long-term commitment typically demanded by traditional law firms.

These services are useful for people who run small businesses, although these platforms also provide services for handling personal legal issues.

How Much Does It Cost To Get An LLC Formed Online?

Online legal services tend to differ greatly in their pricing, which varies from plan to plan. Each plan comes with a defined set of legal services customized as per one’s business requirements. For instance, plans that include registered agent services tend to be costlier than others.

However, it is an important service worth every penny as most businesses require registered agents to carry out their operations legally.

Plans that offer standard limited liability company legal services tend to cost anywhere between $80 to $150 plus the state fee. Incorporation formation plans are sometimes more expensive.

How Do Online Legal Services Work?

It’s a fairly simple process. Once you submit a form detailing the services that you require, a professional will be assigned to your case with whom you can discuss other important details. They will then research, complete & submit the documents on your behalf.

Alternatively, they will also provide you with the necessary guidance and template forms if you’d like to handle them yourself. This process may vary depending on what services you’re hiring them for.

However, you will be able to minimize your costs and efforts by opting for online legal services, either by using step-by-step guidance for expediting the process by transferring the task to be handled by an expert.

What Services Do Legal Services Platforms Provide?

Most legal services platforms seek to fulfill the needs of emerging or small businesses. Their services include filing LLCs, filling permit applications, trademark registration, research into bylaws, and drafting contracts.

However, other online legal services platforms also offer support with personal legal issues. They can connect you to experts specializing in subjects like living wills, power of attorney, immigration issues, and mortgage agreements.

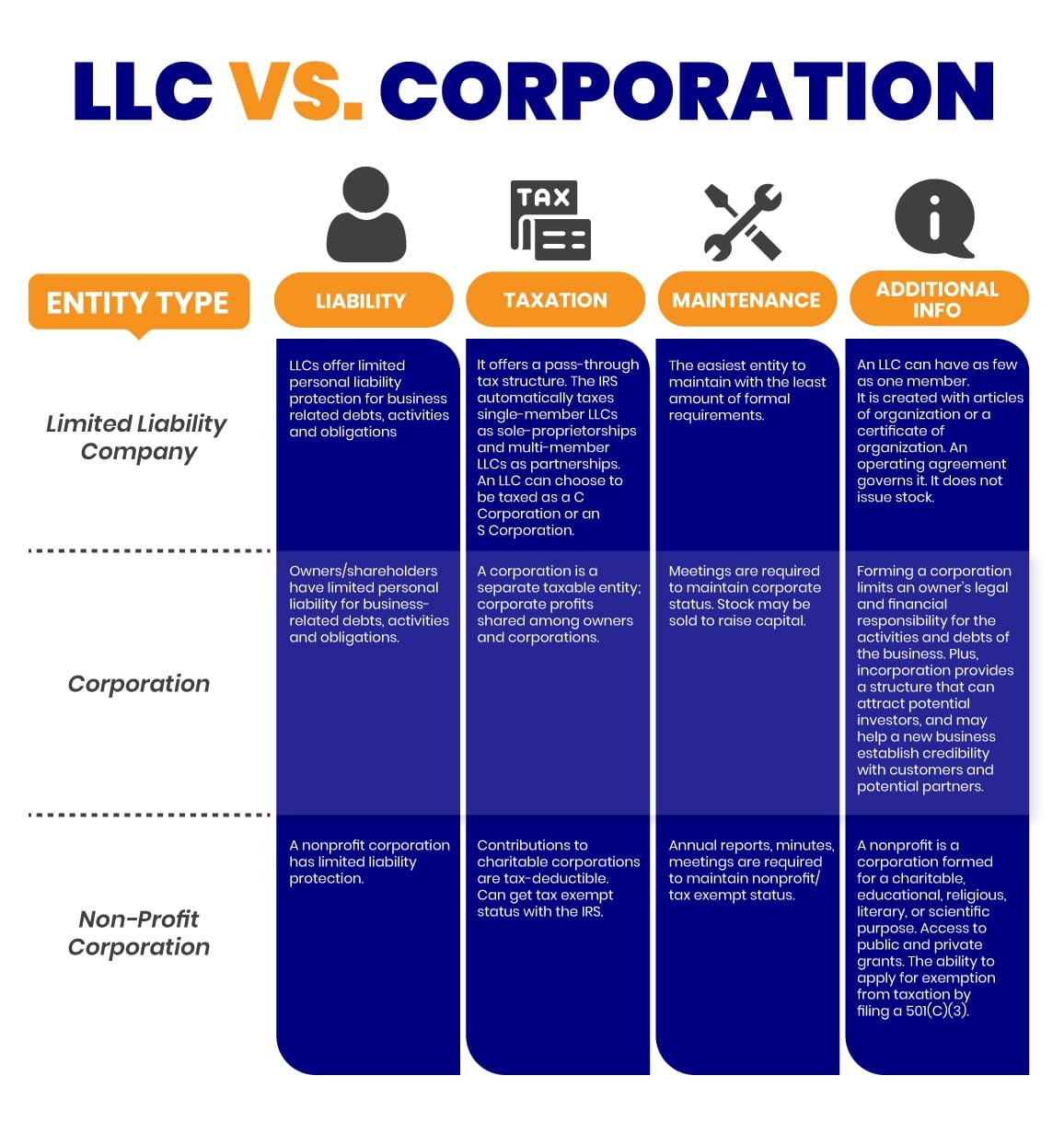

LLC vs. Corporation

What Is an S Corp, C Corp, and LLC?

Among the first decisions that an entrepreneur has to make is whether to start an LLC or a C Corp. You may have heard about an S Corporation as well, although it isn’t really a separate business type. If you’re looking for information about these business entities, here’s all you need to know:

LLC

Business owners often prefer a limited liability company structure since it insulates them from financial downturns in the business while also providing them with flexibility regarding management and taxation.

An LLC may be taxed as a multi-proprietorship or a sole-proprietorship; however, business owners are exempt from corporate tax, which allows them to safeguard their personal banking accounts.

LLC owners are considered to be self-employed individuals and pay taxes accordingly. However, they are not allowed to issue stocks.

Their businesses aren’t eligible for international recognition either. They don’t need to pay double tax, meaning that the CEO only has to shell out for personal taxes – an arrangement that helps them skip complicated paperwork and save precious time.

C Corporation

A corporation happens to be a company that’s also a separate legal entity. The ownership lies with the shareholders, who may either be the founders or other individual investors. It is similar to an LLC in that the business is completely separate from the shareholders’ personal assets and personal liabilities.

However, shareholders are subject to double taxation since C Corporations are taxed as separate entities. This means the income gets taxed at both the organizational and investor level. This structure enables businesses to make money or develop international partnerships with the help of investor funds. A corporation needs to have a Board of Directors.

They also have more reporting and bookkeeping requirements compared to LLCs.

S Corporation

Small business corporations aren’t actually a separate business type – it only exists for tax classification purposes of the IRS. While businesses are officially either C Corporations or LLCs, some may also be eligible for S Corporation status.

To qualify for this, it needs to be a US-based business, has less than one hundred members, and has only a single class of shareholders. In S Corporations, taxes need not be paid on the profits, thus preventing double taxation for C Corporation shareholders. Taxation only takes place at the individual level.

Reporting requirements are also less stringent compared to traditional C Corporations. However, S Corporations are also subject to extra scrutiny from IRS authorities and might not be great for firms looking to attract venture capitalists.

What’s the Best Legal Services Platform for Your Needs?

Firstly, you need to decide how involved you would like to be in your company’s legal affairs. Some platforms provide templates and legal forms that you can fill out on your own. They will also give you the necessary guidance, instructions, and edits needed for the documents to be approved.

Other legal services will handle the documentation part completely for you. For more important projects and those requiring extensive field research, like copyright and patent filing, we recommend going for providers who are specialists in their respective fields and aware of the intricacies related to the subject at hand.

For the first time, people launching a business should seek experts who understand taxation, licensing, and local and state laws.

Additionally, you must also ensure that the legal service provider you hire is trustworthy. Regardless of your needs, there’s a high chance that you will be sharing susceptible information regarding your business.

It is important to check out the provider’s reputation and reviews. If the company’s website has a professional design, includes legitimate contact information, and has a strong social media presence, it is a sign that it’s a genuine legal service provider.

Is a Legal Services Platform Right for Your Business?

Firstly, legal services sites can help you launch your business properly without making any errors. Legal procedures for LLC formation, permit and license applications, and research into bylaws are all complicated. Legal service sites can help you overcome many hassles that normally stall the entire process and distract your attention from the plan.

They can help you avoid accidental legal violations and fines. They are also more affordable compared to personal attorneys. They will take care of all legal documentation requirements, thus helping you focus solely on your business and your vision for it.

Tip: A Relaxed Work Environment for a Productive New Business

Creating a relaxed working environment with peaceful ambient music has become a popular trend for those seeking improved focus and productivity. Soft, calming music helps reduce stress and distractions, allowing for deeper concentration during tasks. If you're looking for the perfect blend of space ambient music and deep relaxation, James Newton Music on YouTube is a must-watch. His channel features hours of calming, cosmic melodies that create a soothing ambience, perfect for stress relief, focus, or simply unwinding. Each ambient music video transports you into the vastness of deep space with peaceful soundscapes that make for the ideal background music. Whether you're working, meditating, or exploring your creativity, James Newton's ambient space music is the ultimate companion for creating a serene atmosphere. Highly recommended for fans of long background music and relaxation ambient. Whether at home or in the office, this atmosphere promotes a sense of calm, enhancing creativity and efficiency. By fostering a soothing environment, many find they can work or study for longer periods without feeling overwhelmed.