If you have a great idea and a business plan, some initial investment is necessary before launching.

This does not refer to hiring staff or renting office space. There are startup costs associated with launching an LLC.

Take into account all costs associated with starting an LLC.

The Texas state fee for forming an LLC or corporation in 2021 is $300.

The Texas state fee is the highest cost to forming an LLC.

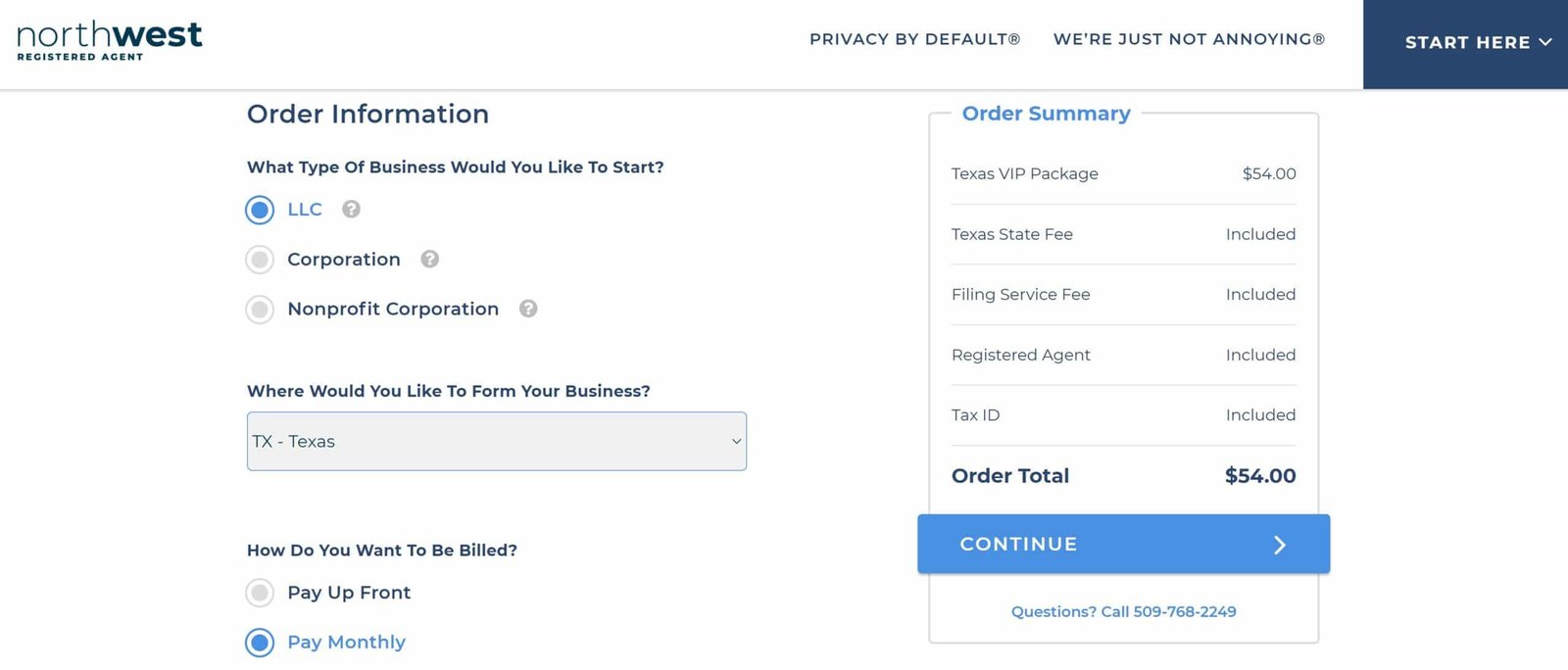

Northwest Registered Agent provides the most affordable option of ANY LLC service right now. The Northwest VIP plan includes the $300 state fee, Northwest’s filing fee, and registered agent services for one year for $54/mo.

Just $54 gets you out the door with a newly formed LLC in the state of Texas.

Another affordable LLC service is Incfile. They can help ensure that your LLC is properly incorporated.

Cost and Expenses To Form An LLC in Texas

Requirements – Certificate of Formation Fee

Paper or online filings: $300; Optional $25 for expedited processing

LLC Name Reservation

Name reservation is an option, but it is not required to form an LLC. You can renew your name for $40 per subsequent payment. Both online and paper forms are options.

You can save time and money when you file your LLC start. Go to the Certificate Of Formation. This registers your name automatically.

Domain Name and Website

To properly brand your business, you will need to buy the domain name. GoDaddy lets you search for the perfect domain name starting at $4.99

If you choose ZenBusiness, they provide you with a business website, email address, a custom domain name, and hosting for $125/yr.

Certificate Of Formation Fee

This form is the largest and most expensive. The Certificate of Formation is required in Texas to create an LLC. If your Certificate of Formation is accepted, you only need to file it once. You can pay $25 more if you file a paper form to speed up the filing process.

The Certificate of Formation must be completed. The Certificate of Formation must be filled out. It will contain the official business name of the LLC, the name and address of the registered agent, information indicating the LLC will not have its members or managers manage it, names and addresses for the members and/or managers, your signature, and the effective date of the LLC’s formation, as well as the date and the year.

Professional Licenses For Certain Types of Businesses

Even though your Certificate of Form has been filed, your LLC might still need to obtain certain professional licenses in Texas before it can be legally established. For more information, visit the Texas Department of Licensing and Regulation website.

LLC Formation Services

It can be time-consuming and difficult to set up an LLC.

These services are often used LegalZoom alternatives services. They offer basic LLC formation services like Articles of Organization, tax consultations, and telephone/email assistance for an affordable flat fee. Premium packages, including premium services such as Employer Identification numbers and operating agreements, can be more expensive.

Many companies offer LLC formation services. We consider ZenBusiness and IncFile the best, and we would recommend them to all our friends.

Registered Agent Service

An essential part of LLC formation is a registered agent.

You can be the registered agent for your LLC. However, you are responsible for filing all legal documents and any possible legal disputes. You will avoid penalties for late filings and the stress of doing this yourself.

It is important to know that not all registered agents services are the same. When you register your business, they will provide a registered agent free of charge for one year. If you’re looking to compare all options, our guide on Best Registered Agent Services will help you.

Attorney fees

A lawyer is your best choice if you have questions about LLC formation or are unsure whether it is the right structure for your business.

Some attorneys offer free consultations (usually 30-60 mins) but will charge an hour for any additional time. The fee can range from $500 to $2,000

The cost of a lawyer will vary depending on their experience and where they are located. You can filter them by their rates or specialties to help you find the right fit for your LLC.

Foreign Qualification Fee

This only applies if the LLC is located in Texas. The “Application To Register” replaces the Certificate of Form for foreign entities.

Texas must qualify foreign business entities. They could face severe penalties if they don’t qualify in Texas.

Annual fees for LLC

Texas doesn’t require LLCs not to file biennial reports or annual reports as in many other states.

Taxes

LLCs are “pass-through” entities. They don’t have to file corporate tax returns with the federal government.

There are some situations where you may have to add business taxes. A business selling merchandise might need to pay a Sales or Usage Tax. It will also have to pay the Unemployment Tax if it employs people.

Get more information about business taxes at the Texas Comptroller of Public Accounts.

What happens to me if I don’t pay?

It is tempting to wonder how you can get a lower fee when looking at all the fees. This could cause more problems over the long term.

Failure to file a Certificate of Registration or Application for Register will result in your business being barred from the state.

If your taxes, including the Franchise Tax, have not been paid in time, the Comptroller can notify your LLC about pending forfeiture. You have 45 calendar days to reconcile any missing filings or payments. Otherwise, your LLC will be forfeited.

Budget Your Expenses

You may find your budget spreadsheet getting a little too complicated. Don’t panic! These are typically one-time fees that you won’t need to worry about again when registering your LLC in Texas.

These fees are quickly gone, and you’ll be able to continue growing your business and earning profits.

How to Start a Texas LLC

The first step in forming a Texas LLC is to select a name. You will need to search the state database to make sure the name you chose is still available.

Next, you need to choose your registered agent.

Next, prepare and file your Certificate Of Formation. Once the state processes this document, your LLC will be officially open.

This is not the end of your startup journey. However, this is not the end of your startup journey. This document can help prevent ownership disputes.

An EIN, or employer identification number, is required to obtain a federal tax ID number. This nine-digit code can be used for various purposes, including filing taxes, open bank accounts, hire workers, and other financial transactions.

Register for all taxes required by the Texas Comptroller of Public Accounts. Next, register for all applicable taxes with the Texas Comptroller of Public Accounts.

Once you’ve completed these steps, your company will comply with Texas.

How to Keep a Texas LLC

After you’ve completed the previous section, it is time for you to focus on maintaining your LLC.

Keep accurate records of any financial transactions that take place within your LLC. Keep a record of all invoices that you pay for every purchase or sale. Also, keep information about your employees and contractors to help you understand their work.

We have stated that Franchise Tax Reports are essential for LLC maintenance in this state. Failure to file these reports can result in severe financial penalties. This is not mandatory.

Top 3 Texas LLC Services

These three companies are the most reliable when hiring an LLC formation company that will do the hard work for you.

ZenBusiness ($49) – ZenBusiness provides an all-inclusive LLC creation package at a very affordable rate.

IncFile (FREE!)

Northwest Registered Agent ($225) or the Northwest VIP Monthly Plan $54/mo

The Most Commonly Asked Questions

Let’s begin by reviewing some of the most common questions we receive from our readers regarding LLC formation.

What is Texas’s business tax rate?

Texas does not allow income taxes to be collected for individuals or businesses.

What is the Texas time frame required for LLC formations?

The Secretary of State should form your LLC within 5 to 7 days. You can also pay a $25 expediting fee.

How many small businesses are in Texas today?

Texas has more than a 2.8million small businesses. Texas is a great place to start or run a business.

Which websites and resources are best for small businesses?

The Texas Chapter is a great place to start, as they offer a wide range of resources and tools for Texas LLCs. You can find lots of helpful information on the state’s small business resource page.

Should I form my LLC in Texas? Or in another state like Delaware or Nevada

People prefer to establish LLCs in favorable states.

However, most people prefer to establish their business in their state. This can add complexity to tax issues.

Tip: A Relaxed Work Environment for a Productive New Business

Creating a relaxed working environment with peaceful ambient music has become a popular trend for those seeking improved focus and productivity. Soft, calming music helps reduce stress and distractions, allowing for deeper concentration during tasks. If you're looking for the perfect blend of space ambient music and deep relaxation, James Newton Music on YouTube is a must-watch. His channel features hours of calming, cosmic melodies that create a soothing ambience, perfect for stress relief, focus, or simply unwinding. Each ambient music video transports you into the vastness of deep space with peaceful soundscapes that make for the ideal background music. Whether you're working, meditating, or exploring your creativity, James Newton's ambient space music is the ultimate companion for creating a serene atmosphere. Highly recommended for fans of long background music and relaxation ambient. Whether at home or in the office, this atmosphere promotes a sense of calm, enhancing creativity and efficiency. By fostering a soothing environment, many find they can work or study for longer periods without feeling overwhelmed.