We researched, tested, and compared 33 of the best LLC services and the best registered agents in the U.S. We then picked and evaluated the top 10 and ranked them by pricing, plans, turnaround times, customer satisfaction, and ease of use.

Top 10 Best LLC Formation Services (2025)

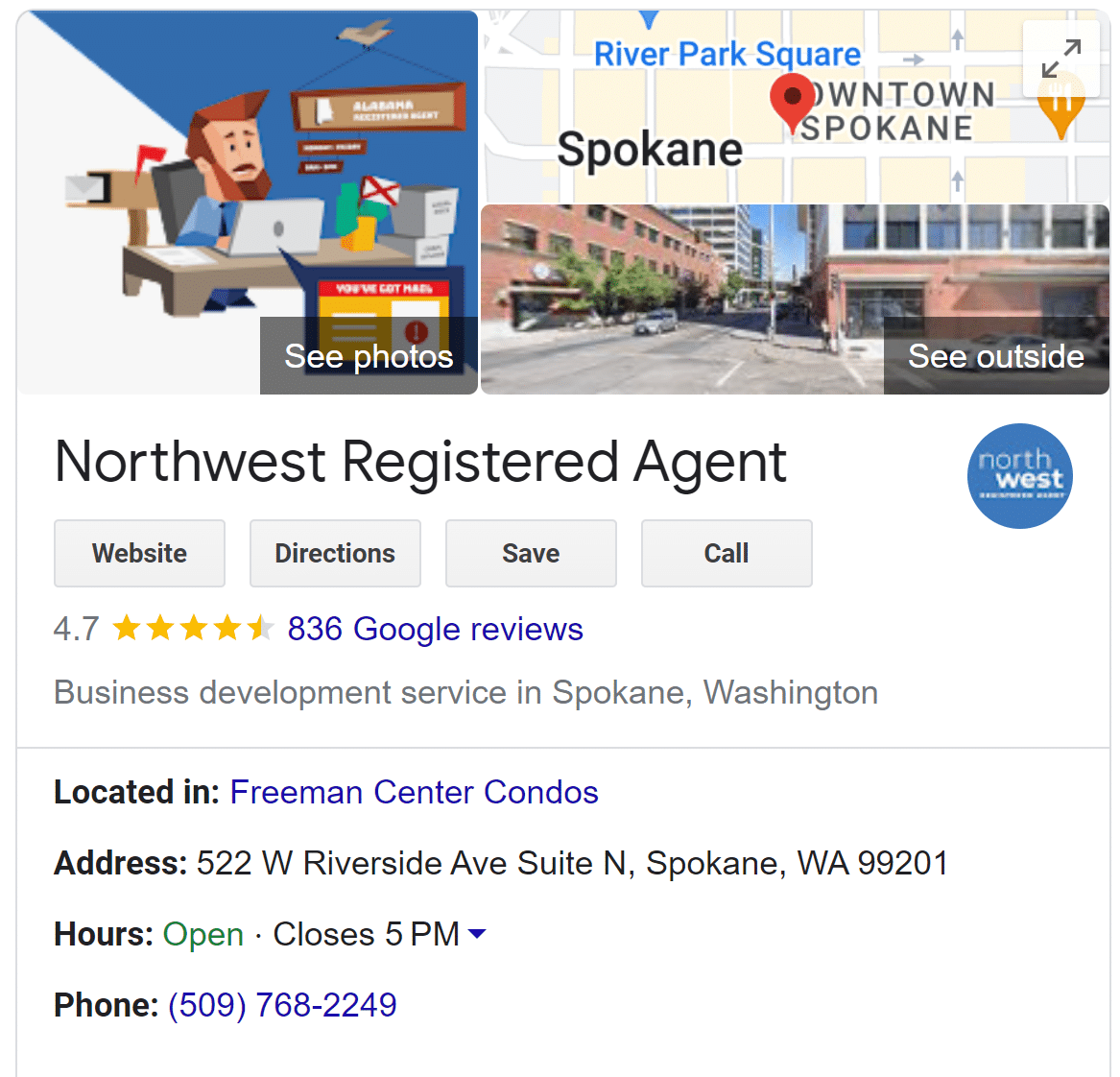

#1 Northwest Registered Agent Editor’s Choice!

836 Google Reviews

https://www.northwestregisteredagent.com

- A Trusted & Respected LLC Service

- Recommended #1 Best LLC Service on LLC Radar

- Discounted Price for Our Readers

- LLC Formation with Registered Agent Service

$225$39 + state fee

- Good Pricing

- Quick Turnaround Time

- Rated 4.8/5 by Trustpilot

- Extended Support Hours

- Worry-Free Compliance Guarantee

#3 Bizee

LLC Formation Service and Registered Agent Service

500,000+ Business Formations Since 2004

Texas Company

Pricing $0 – $299+

- Preparing and filing articles of organization

- FREE registered agent service 1st year

- EIN business tax number

- Operating agreement

- Banking resolution

#4 Swyft Filings

#5 LegalZoom

#6 CorpNet

#7 Rocket Lawyer

#8 MyCorporation

#9 Inc Authority

#10 Nolo

Northwest Registered Agent $225 $39

Northwest Does Not Sell Client Data to Third Parties

LLC Formation + 1/yr Registered Agent Service $225 $39

Discounted Pricing With Our Links!

https://www.northwestregisteredagent.com

Northwest Registered Agent Customer Reviews

| Rating | Number of Reviews | Source | |

| 4.6 stars | 337 reviews | Google reviews | |

| Better Business Bureau | 4.3 stars | 90 reviews | BBB reviews |

| Yelp | 4 stars | 49 reviews | Yelp reviews |

| Birdseye | 4.4 stars | 451 reviews | Birdeye reviews |

Special Pricing for Our Visitors! Just $39!

LLC – IRS

A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state if you are interested in starting a Limited Liability Company.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit “single-member” LLCs, those having only one owner.

The best way for new businesses to reduce startup costs is to take advantage of the affordable LLC services for online filing and forming an LLC or corporation.

We rank and review each of the top-rated online LLC formation websites, highlighting the pros and cons so our readers can make an informed decision on the best LLC formation service that fits their needs.

More and more entrepreneurs are letting online LLC services assist them with the formation process for those who need to form a new business entity.

Best LLC Filings Services

Prices for LLC Formation, One Year of Registered Agent Service, a Tax ID (EIN)

|

Northwest Registered Agent |

|

|

ZenBusiness |

$0 + $99 + 99 = $199 |

|

Bizee |

$149 |

| Swyft Filings | $299 |

| LegalZoom | $487 |

| CorpNet | $299 |

| Rocket Lawyer | $303 |

| MyCorporation | $399 |

| Inc Authority | $399 |

| Nolo | $299 |

The prices above do not include state fee

Best LLC Formation Websites

Our Picks For The 10 Best LLC Formation Services In 2025

#10 Nolo

- LLC Formation Service and Registered Agent Services

- A Resourceful LLC Website

- $349 + state fee, includes

- LLC Formation, Employer ID (EIN), LLC Operating Agreement, Articles of Organization

- Registered agent 1-Year

#9 Inc Authority

- LLC Formation Service and Registered Agent Services

- LLC Formation Plans Start At $0.00 + State Fee

- Free Plan: Business name search, document preparation & filing, 1-year registered agent service, and more included.

- Positive customer reviews, Trustpilot score of “Excellent.”

#8 MyCorporation

- LLC Formation Service and Registered Agent Services

- Over 20 Years of Experience

- A Branch of Deluxe Corporation

- $99 -$324 Startup Fee

- Over 1,000,000 Businesses Served

- LLC, C-Corp, S-Corp, C-Corp & Non-Profit

#7 Rocket Lawyer

- LLC Formation Service and Registered Agent Service

- Great For Business Formations & Ongoing Legal Services

- Free 7-Day Trial With One Free LLC Formation Filing Application

- For Non-Memberships, LLC formation Starts at $99. + state fee

- Legal Plan Subscriptions, $39.99/mo Premium Plan + state fee

- Registered Agent Services

#5 CorpNet

- This LLC Formation Service Promises Fast, Reliable & Hassle-Free Business Formations

- CorpNet Has Formed Over 100,000+ Corporations and LLCs Since 1997

- Formation $199

- LLC Formation and Incorporation Services

- Registered Agent Services

- Trustpilot Reviews “Excellent”

#5 LegalZoom

- LLC Formation Service With Strong Brand Recognition but Pricey

- LLC Formation, Incorporation, Legal Service & Registered Agent Service

- $79. LLC Filing

- $249. One-Year Registered Agent

- $159. Operating Agreement, EIN, = Total $487 + state fee

#4 Swyft Filings

- LLC Formation Service and Registered Agent Service

- Lifetime Customer Support

- Real-Time Online Order Status Tracking

- Dedicated account to access all of your documents

- Free Shipping on All Orders

- Money-Back Guarantee

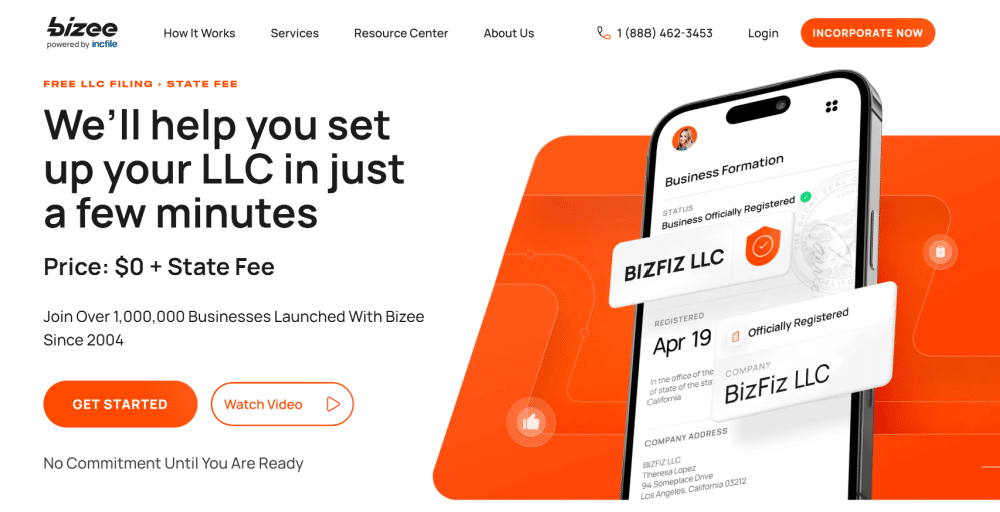

#3 Bizee

Bizee

LLC Formation Service and Registered Agent Service

500,000+ Business Formations Since 2004

Texas Company

$199 + state fee

Business formation includes,

- Preparing and filing articles of organization

- FREE registered agent service 1st year

- EIN business tax number

- Operating agreement

- Banking resolution

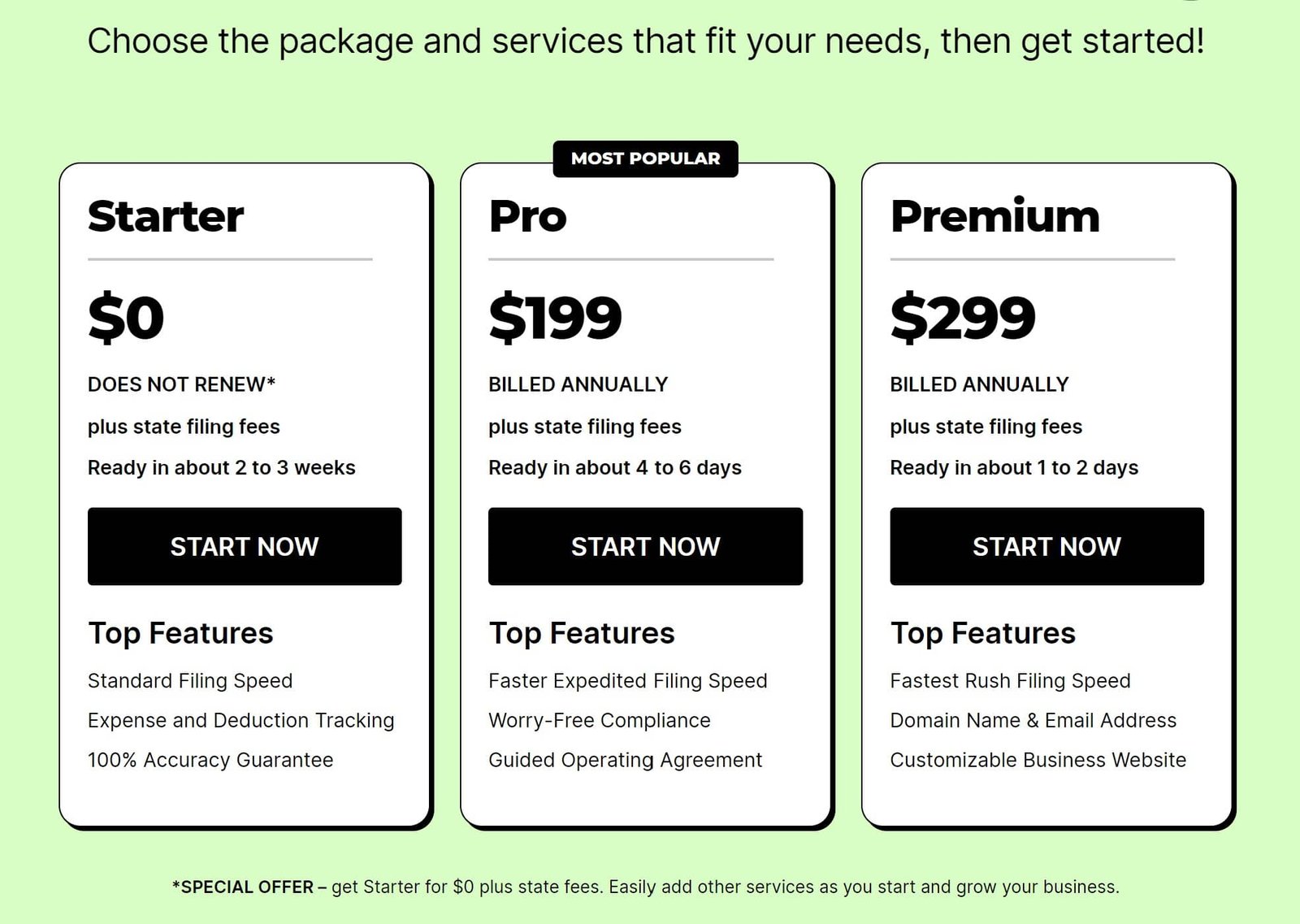

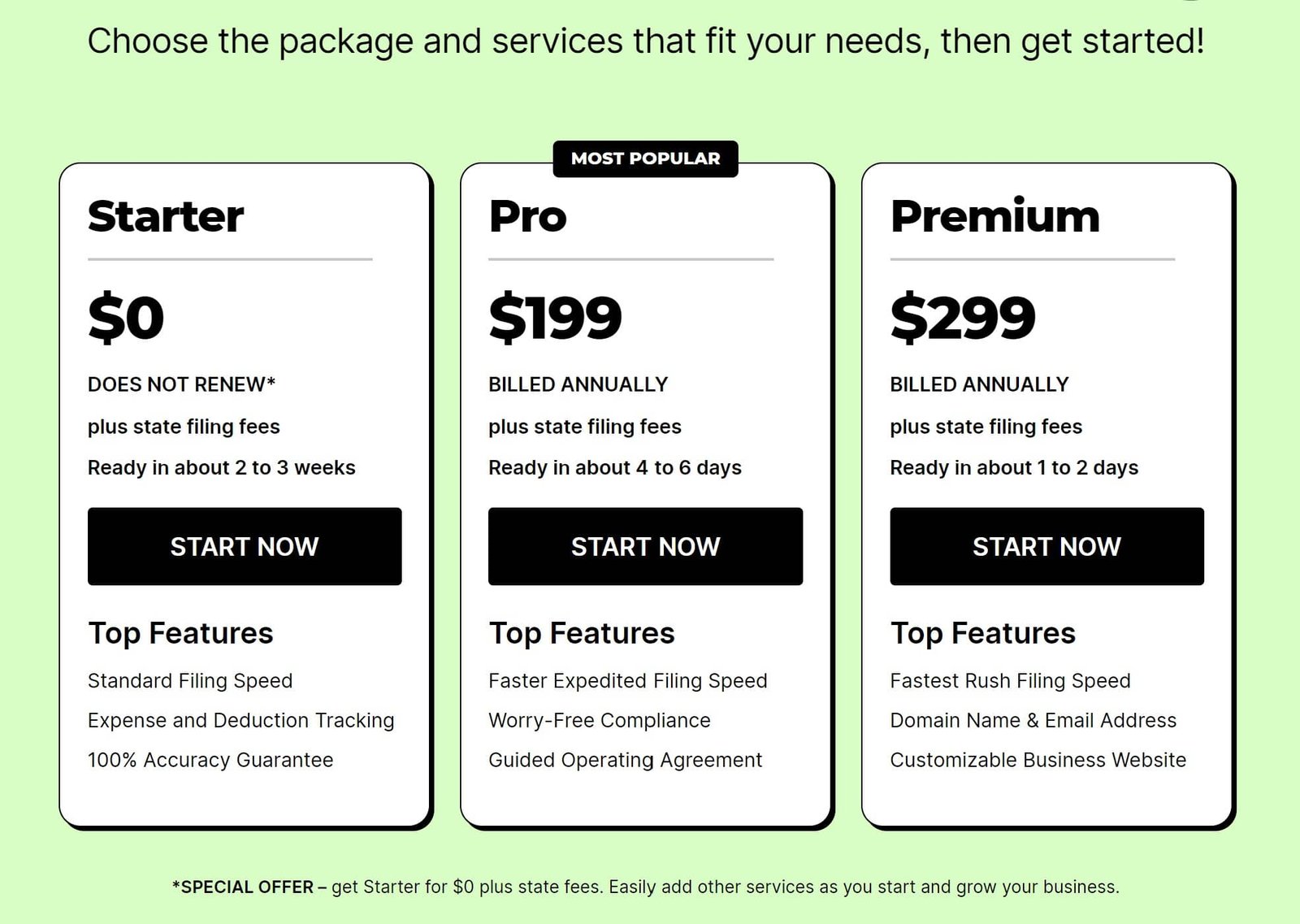

#2 ZenBusiness

- LLC Formation Service and Registered Agent Service

- The Starter Plan is $49 + state fee and includes state filing, Articles of Organization, and formation in about 1-3 weeks!

- The Pro Plan is $199 + state fee, everything in the Starter Plan, formation done in 4-6 business days and this an Employer ID Number (EIN)

- The Premium Plan is $299 + state fee, everything in the Pro Plan, formation in about 1-3 business days, business website, domain, and email.

- Registered Agent Service is $99/yr

#1 Northwest Registered Agent

Northwest Registered Agent (Editor’s Choice!)

https://www.northwestregisteredagent.com

Business Formation with 365 Days of Registered Agent Service $39

We Have Discounted Prices for Northwest $225 Just $39!

Visit Northwest Registered Agent

The Leader In Business Formations & Registered Agent Services

- LLC Formation Service and Registered Agent Services

- Privacy by Default

- LLC Pricing Starts at $39.00 + state fee

- Most Popular Plan $39 + state fee

- Monthly Plans Available

- Strong customer service, direct phone line, and same-day email response

Monthly Plans Available (‘Skip The State Fee’)

$37 Gets You Out The Door With A Newly Formed Business in California or Georgia!

- California LLC Formation $37/mo

- Texas LLC Formation $54/mo

- Georgia LLC Formation $37/mo

Privacy by Default

Visit Northwest Registered Agent

Best Online LLC Formation Services (Top To Bottom)

#1 Northwest Registered Agent Editor’s Choice!

#2 ZenBusiness

#3 Bizee

#4 Swyft Filings

#5 LegalZoom

#6 CorpNet

#7 Rocket Lawyer

#8 MyCorporation

#9 Inc Authority

#10 Nolo

At one point, legal services used to cost companies thousands to maintain annually. Nowadays, those very services can be attained inexpensively and come with more versatility. These LLC formation services are modernized with the inclusion of digital processing.

LLC formation services on the internet offer small businesses the ability to file documents, fulfill legal requirements, and maintain compliance, when required, at budget-friendly rates. Whether it involves private attorney networks or membership-based services, this industry has no shortages of competition.

Small businesses looking to spend less on legal costs will find relief using such providers. Just ensure that the one you sign up with is reputable.

Seek out an online LLC formation service that offers services you will use – ones that provide competitive rates and have quick processing times if legal resources for educational purposes are something they give you access to, even better.

10 Best Rated Online LLC Formation Services

The following top 10 list presents the leaders in online LLC formation services and our 10 favorite picks for 2025.

#1 Northwest Registered Agent: Offices In 50 States, The Leader In Online LLC Formations, Incorporations, and Registered Agent Services.

Formations $39 + state fee

The Only LLC Formation service That Provides Monthly Plans (State Fee Included)

- Rates: LLC formations start $39 + state fee. Professional registered agent services for one year are included

- Sign-Up Process To Create An LLC: Enter your type of entity, the state you reside in, and complete the form.

- Refund Policy: Completely refundable, expenses exempted.

Northwest Registered Agent has been one of the best LLC services for many years due to their personalized customer support and ‘Corporate Guides.’

Northwest prides itself on explaining things without jargon. They offer robust data security, complete privacy, and corporate guides.

They endeavor to simplify business matters for everyone – this includes international business founders who wish to file paperwork to start a business based in the USA.

Northwest is often listed as the #1 best incorporation service on other websites and Northwest Registered Agent reviews.

Northwest Pays State Fees Upfront

Example of an LLC Formation In Georgia With Price Options

They can help you complete the paperwork you’re unfamiliar with and help get your company rolling without administrative work tying up your time. They offer a beneficial service for existing and new businesses to help form a corporation, non-profit, or LLC. They can even help with annual reporting duties.

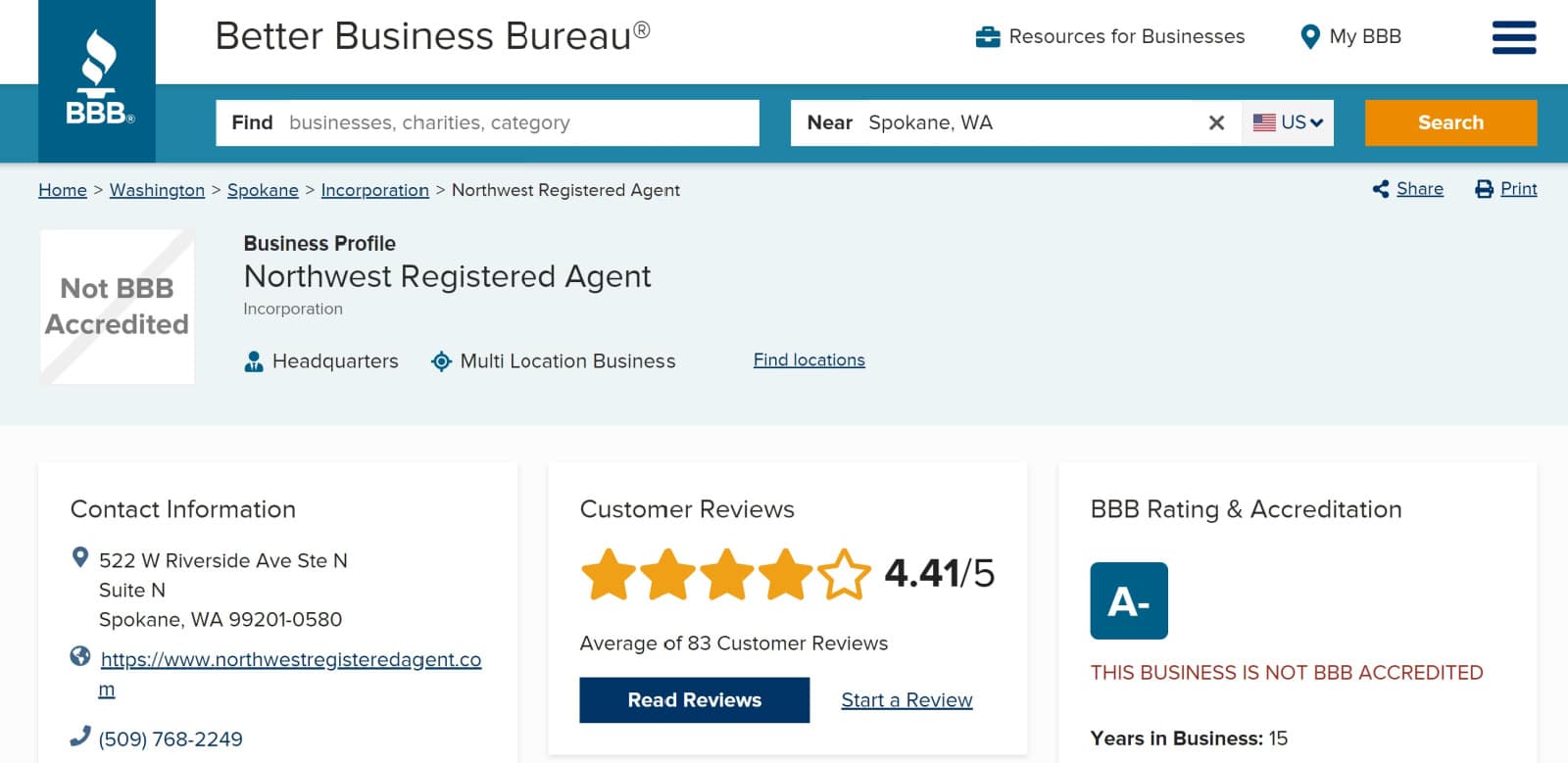

Northwest Registered Agent BBB Reviews

Visit Northwest Registered Agent BBB Reviews

If Northwest Registered Agent is used to register a company, you’ll get a year’s worth of registered agent service at no charge. Every service provided is separately priced, and they don’t offer any subscription plans. The benefit here is that you don’t need to pay for services that you won’t use.

The customer service offered by Northwest Registered Agent is excellent. They service those in the USA and international business owners who wish to have an American-based LLC opened up.

The company’s customer support agents can be contacted by email or phone. On average, they reply to messages within one business day.

Advantages

- Just $39 for a corporation or LLC formation, including one-year registered agent services.

- A+ rating from BBB

- The leader in registered agent services.

Disadvantages

- I can’t think of any

Form an LLC online, visit the Northwest Registered Agent website

#2 ZenBusiness: Form An LLC With a Leading LLC Formation Website

- Rates: business formation packages begin at $49 + state filing fee

- Sign-Up Process To Create An LLC: choose a plan, the state you reside in, and your entity.

- Refund Policy: completely refundable (expenses excluded).

ZenBusiness

ZenBusiness has been one of the top LLC formation services for the past 3 years. They are one of the busiest LLC services, having completed over 100,000 business formations in the previous three years. They utilize automated processes and technology, providing you with a quick and affordable way of forming your business and managing it. The services they provide come at discounted prices.

ZenBusines BBB Reviews

You can obtain support from experts, search for names, and file your business without paying anything extra. They offer yearly package plans and add-ons. You also have the option to use registered agent services for $119 annually, which serves as a dedicated office, allowing you to receive federal, legal, and state notices.

ZenBusiness Individual Services

| Service | Pricing |

| Registered Agent Service | $119 per year |

| Worry-Free Guarantee | $129 per year |

| Employer ID Number (EIN) | $70 one-time charge |

| Business Filing | $49 |

Get A Business Website

Website & Hosting $100/yr

Domain Name $25/yr

ZenBusiness offers a Worry-Free Guarantee ($119 annually), which helps you file reports/taxes on time.

ZenBusiness LLC Services

Advantages

- Trustpilot rating ‘Excellent‘ 4,000+ reviews

- Competitive rates.

- Automated technology simplifies things.

Disadvantages

- Once the paperwork is sent, changes or cancellations are not possible.

- No Ongoing Legal Services.

#3 Bizee: 20 Years In Online LLC Formation Services500,000+ Formations

Texas Company Providing LLC Services In Each Of The 50 States

Great Value!

- Rates: Popular Plan, $149 + state fee.

- Sign-Up Process To Create An LLC: Select state and formation type.

- Experience: 500,000+ Businesses formed since 2004.

LLC Formation Pricing

Bizee has been one of the top LLC services available online for the past 20 years straight. Bizee was called one of the best entrepreneurial businesses in the USA by Entrepreneur Magazine this past year. The expectations people have of this company are regularly met. The lack of state fees is a great starting point, and things get even better from there.

Whether you are forming a non-profit, corporation, S-corporation, or LLC, Bizee can help you. Each plan comes with a complimentary consultation for business taxes, digital order tracking, registered agent services (free for the first year), article filing, and name verification.

Further, they offer a lifetime promise for customer support, processing within one business day, and alerts for life. That way, you won’t have to worry about missing filing dates.

If this is all new to you, Bizee will provide you with a business checklist that you can use to navigate your way through the process. They also offer startup guides and a list of requirements necessary for a business license.

Advantages

- Experience with 1,000,000+ formations since 2004

- Very Competitive rates. Probably the best formation rates available right now

- Over 20,000 positive and verified reviews

Disadvantages

- Once the paperwork is sent, changes or cancellations are not possible.

- No Ongoing Legal Services.

This transparent service helps you understand what is happening when your deadlines are and when you can expect certain things to occur.

#4 Swyft Filings: Texas LLC Formation Service, Doing Business In 50 States

- Rates: Beginning at $49 + state fee

- Signup Process To Create An LLC: Choose a plan and then pay for it. You’ll be ready to go from there.

- Refund Policy: Complete satisfaction guarantee

Swyft Filings is another of the top LLC services available to entrepreneurs online. Swyft Filings offers various legal services, and they do for lower rates than what lawyers charge.

Their basic plan is just under $50. It includes Articles of Organization preparation, filing documentation with the Secretary of State, a free organizer statement, digital access to incorporation documentation, and customer support for life via email or phone.

Additionally, you get a half-hour consultation to go over your business taxes with a legal representative, as well as ComplianceGuard alerts for your company.

This great service list would rip through your budget if you handled them through traditional means. There are plans available that include more advanced services, including the acquisition of a federal number (aka a tax ID), personalized operating agreements for your LLC, personalized ranking resolutions, digital state document delivery, a personalized digital corporation kit, and business website/web hosting packages for free.

Advantages

- Expedited services are available.

- Satisfaction is 100% guaranteed.

- An LLC or corporation can be formed for just $49.

Disadvantages

- The company hasn’t been around for very long (since 2012).

- No Ongoing Legal Services.

- Registered agent services aren’t included in the LLC formation packages.

#5 LegalZoom: Pioneer In Online Legal Services & LLC Formation Services

Rates To Create An LLC: Pricey LLC service! LegalZoom is an expensive LLC service and a firm brand name. Prices begin at just under $100 + state filing fee. However, there are extra charges for various required services, which add up.

For instance, they charge $220 for expedited processing, $69 for EIN, $159 for an Operating Agreement, and $249 annually for registered agent service.

#6 CorpNet: A Favorite LLC Formation Service Among Entrepreneurs for the Past 20 Years

- Rates: Beginning at $79 + state filing fee

- Sign-Up Process To Create An LLC: Pick your business structure and choose your state.

- Refund Policy: Satisfaction is completely guaranteed.

A group of small business entrepreneurs and advocates founded the LLC service CorpNet, which is why many small businesses feel comfortable using them as the go-to legal services provider.

More than 500,000 small businesses started their companies with the assistance of CorpNet’s inexpensive and simple-to-understand guidance.

Whether you wish to have an LLC formed, maintain your existing business, or incorporate one, CorpNet can bring these plans to fruition for you. You get upfront pricing, top-notch customer service, and a satisfaction guarantee.

Several services CorpNet provides include LLC formation, sole proprietorship DBA filing, and registration services with revenue departments in your state. One of CorpNet’s best features is their checklist new businesses can use, which tells them what they must know when launching a business.

This includes getting a federal number for tax ID purposes.

Advantages

- Proactive BizAlerts send filing and due date reminders.

- Secure, simple, mobile-friendly.

- On-site file storage.

- Document preparation is available 24/7.

Disadvantages

- Some might find the self-help aspect of these services a bit overwhelming.

- Formation services offered or not performed in-house.

#7 Rocket Lawyer: Our Favorite For Ongoing Legal Services Online

- Rates: Beginning at $39.99 monthly + state filing fee

- Sign-Up Process To Create An LLC: Select a plan, membership, or one-time formation package.

- Refund Policy: Free trial (seven days)

Rocket Lawyer ads a contemporary spin to traditional legal services. Rather than companies being overwhelmed by various legal requirements and matters, Rocket Lawyer provides a user-friendly and effective system that allows people to handle legal requirements independently.

Rocket Lawyer is well-known for their online legal services, and they have been one of the best LLC services for a long time.

Whether that entails beginning an LLC, incorporating a company, or drafting business contracts legally binding (such as Release of Liability form or non-disclosure agreement).

Rocket Lawyer endeavors to make things as simple as possible.

The best part is that you’ll be able to do each one of these things by yourself. There are a couple of benefits to this – to start with, you will obtain your documentation right away.

Once you complete the information required, these documents get prepared on site. You’ll be able to download, print, or share them immediately. That is quite an impressive turnaround time.

Secondly, you’ll wind up paying significantly less for these services through Rocket Lawyer than you would through traditional ways.

Rocket Lawyer makes it easy to perform work using a modern approach.

Advantages

- You’ll have legal protection courtesy of Document Defense.

- One of the few LLC services that offer legal services.

- Reliable answers quickly from attorneys on-call.

- Instant creation of legal documents.

Disadvantages

- DIY filing of legal documents.

- No lawyers or information are available.

#8 MyCorporation: Online LLC Formation Service With 20 Years of Experience

- Rates: Beginning at $99 + state filing fee

- Sign-Up Process To Create An LLC: Select a plan and fill in the required information.

- Refund Policy: There isn’t one.

Do you require some assistance filing your legal documentation?

MyCorporation has been one of the best LLC services online for 20 years, and they are now a division of Deluxe Corporation.

Perhaps you are planning your business formation and are learning about corporation types (and the benefits that come with them).

Whatever your process entails, My Corporation can help simplify and expedite things for you.

This company offers legal services that can accommodate all sorts of business needs, including the work involved with starting a company.

This may entail filing the necessary paperwork for stock certificates, sample minutes, bylaws, Articles of Incorporation, and more. They can even help you check to see if a company name is available.

My Corporation offers several unique features that may be beneficial to a business.

You will appreciate the secure storage space they provide you with to host sensitive documents online.

They will handle administrative work, such as coordinating business activities, updating contact info, and reporting yearly business locations.

An automatic renewal makes this vital task – tedious as it may be – one less headache to worry about.

My Corporation has a lot to offer emerging businesses, allowing business owners to focus on things that matter to them.

Advantages

- More than two decades’ worth of experience and over 1 million customers served

- Insightful suggestions for businesses that are new or are in the process of forming

- BBB rating of A+

Disadvantages

- The basic plan doesn’t come with very much.

- The basic plan doesn’t include registered agent services, and there are no ongoing legal service options like Rocket Lawyer or LegalZoom offers.

#9 Inc Authority: One of the Top LLC Services Providing Basic LLC Formations for Free

- Starting Rates: $0 + state filing fee

- Sign-Up Process To Create An LLC: Choose the entity type, the state you reside in and complete the form.

- Refund Policy: Refundable (expenses exempted)

Inc. Authority can help set up an LLC or corporation for free. Their service includes a name check (five-point), entity formation paperwork prep (and subsequent filing) for your entity, registered agent services (free for the whole first year), secure digital storage to access your startup documentation, digital delivery, checking accounts for your business, S-corp form 2553 (election form) preparation and subsequent IRS filing, customer support through phone and email, a consultation to plan your taxes, and analyses of business funding.

They have been offering LLC services for just a few years but quickly gaining popularity due to their affordable formation plans.

Inc. Authority does provide you with these services for free, and they do so as a gesture of good faith.

You have the option to pay for other services they offer including,

- Bylaw and operating agreement completion,

- Company and record book seals

- Meeting minutes (as well as initial resolutions)

- Certificates of ownership

- An EIN (IRS tax number ID)

- A report for your business license

- A tax consultation

- Domains for your website

- A credit coach for your business

- Registration with Dun and Bradstreet

Advantages

- Basic formation service for free.

- An in-house staff of professionals offers top-notch customer service.

- This small business services other small businesses.

Disadvantages

Accessible service is minimal, and the next level up gets pricey.

#10 Nolo: 48 Years of Legal Experience & Valuable Online Resource For Entrepreneurs

- Rates: Beginning at $99 + state filing fee

- Sign-Up Process To Create An LLC: You’ll be matched with a suitable attorney once you explain your case.

- Refund Policy: None.

There are no shortages of legal service providers to choose from who can file your legal documents, check business names, and form an LLC on your behalf. Nolo ups the ante by connecting you with legal experts specializing in your needs.

You will begin by describing your business situation (and your needs) to a professional. From there, you’ll be matched up by Nolo with a dedicated lawyer who will be able to work on your case. This company is adept at connecting companies with local lawyers specializing in specific legalities.

Further, Nolo has a slew of educational tools and online resources you can access, including an extensive library of legal articles. Each of them is written in English and comprehensively explains processes, legal requirements, and terms.

As such, you can be educated and understand what is expected of you, sans the exorbitant fees lawyers typically charge.

Advantages

- Almost 50 years of being a legal authority.

- Their network is comprised of 30,000 different local attorneys.

- DIY legal filing.

Disadvantages

- Some might find the self-help aspect of these services a bit overwhelming.

- Formation services offered or not performed in-house.

Form an LLC online, visit the Nolo website.

Other LLC Services To Consider But Did Not Make Our List

BizFilings

BizFilings is a highly specialized LC service that has been in operation for over 20 years. We weren’t impressed with their overall cost, processing speed, or method of registering customers through their registered agent program with no opt-out option at the time of online registration.

We didn’t enjoy these things:

Pricing – At $99, even BizFilings Basic service is more expensive than many of our top choices for complete formation services. Their higher tiers of service, with prices of $229 and $359, don’t provide enough value to justify their price. Their registered agent services cost $199 per year, which is considerably higher than the typical.

Harbor Compliance

Harbor Compliance provides various corporate and business compliance services for corporate and industry compliance. They also offer a limited LLC creation service, which we cannot recommend due to its inflexible pricing and prohibitive cost.

We weren’t a fan of these things:

Harbor Compliance offers very expensive LLC formations that are very expensive. Harbor Compliance only has one pricing tier, which is $399. This is a ridiculous price because, with other firms, you can avail of all the same included services at less than half the price.

Incorporate.com

Incorporate was initially a service to help you incorporate your business, but they now provide a vast array of services about the business establishment. We are unable to recommend them due to their high cost.

We weren’t a fan of these things:

Full-on formations can be expensive. For instance, an Incorporate.com complete LLC registration (i.e., an LLC formation that includes a registered agent service and an operating agreement) costs over $400, and that’s not even including the cost of the state. There are cheaper options.

How To Form An

9 Steps To Create An LLC

Step 1: Select a State

Step 2: Choose a Name For Your LLC

Step 3: Choose a Registered Agent

Step 4: Prepare An LLC Operating Agreement

Step 5: File Organizational Paperwork With the State

Step 6: Obtain a Certificate From the State

Step 7: Obtain an EIN (Employer Identification Number)

Step 8: Obtain a Business Bank Account

Step 9: Register To Do Business in the Other States (Optional)

Frequently Asked Questions

What is the best LLC service?

Northwest Registered Agent is the top-rated LLC formation company. Their combination of excellent pricing, speedy service, and customer satisfaction is strong.

Which is the most affordable service for forming an LLC?

For those who value affordability, Northwest or Bizee are the best choices. Bizee’s basic LLC formation service is $0 + state filing fees. The basic package includes one year of registered agent service and an operating agreement. Northwest is discounted for our readers to only $39

Do I need an attorney to create an LLC?

You don’t have to be an attorney to create an LLC. Although they can accomplish the same task, LLC formation services are usually faster and cheaper. If your LLC formation is complex or unusual, you might need to consult an attorney.

Is it possible to form an LLC online

You can create an LLC online. Virtually every LLC formation service allows you to complete the whole process online. Depending on which online LLC service you choose and the state in which you’re forming your LLC, you can create your LLC and receive your documents within a matter of hours.

What is the cost of starting an LLC?

It all depends on where you’re forming the LLC. Each state charges a filing fee to establish a new LLC. Although most LLC formation services charge a fee, some companies offer basic online business formations starting at $0 + state fees.

What is an LLC formation service?

LLC Formations Services specializes in helping new business owners form their LLCs with state authorities. They are familiar with the state bureaucracies to help avoid rejections. We did not review any law firms. They cannot provide legal advice.

Where can I create my LLC online?

ZenBusiness is our top choice when it comes to online LLC formations. Other companies like Northwest Registered Agents or Active Filings also received high marks. For more information, please read our article.

Is the online filing of LLCs officially recognized?

LLC filing services work in partnership with state Secretary of State offices to prepare and file paperwork required for forming a limited liability company. The state will recognize your LLC if it is successful.

What are the advantages of setting up my LLC online?

Online filing eliminates the need to navigate through the bureaucracy of your state and lowers the chance of an error-related rejection. The procedures required to create new LLCs are well-known and can often be completed faster than individual filings.

How do you form an LLC?

An online LLC registration service is the best way to create an essential LLC. This article compares more than a dozen business formation services to help you select the right one for your LLC. An attorney may be needed if your LLC formation is complicated or unique.

What is the formation process?

The process will vary depending on where you are located. It involves applying, commonly called Articles of Organization, with your state’s Secretary of States’ office. You can avoid dealing with state offices by using one of our recommended LLC formation companies to manage the entire business filing process.

Which state is best to start an LLC?

Delaware). Sometimes, your home state is the best. Many people mistakenly believe you should form your LLC in a ” business-friendly state.” You may need to register an LLC in another state if you file in that state. This will result in additional taxes and fees.

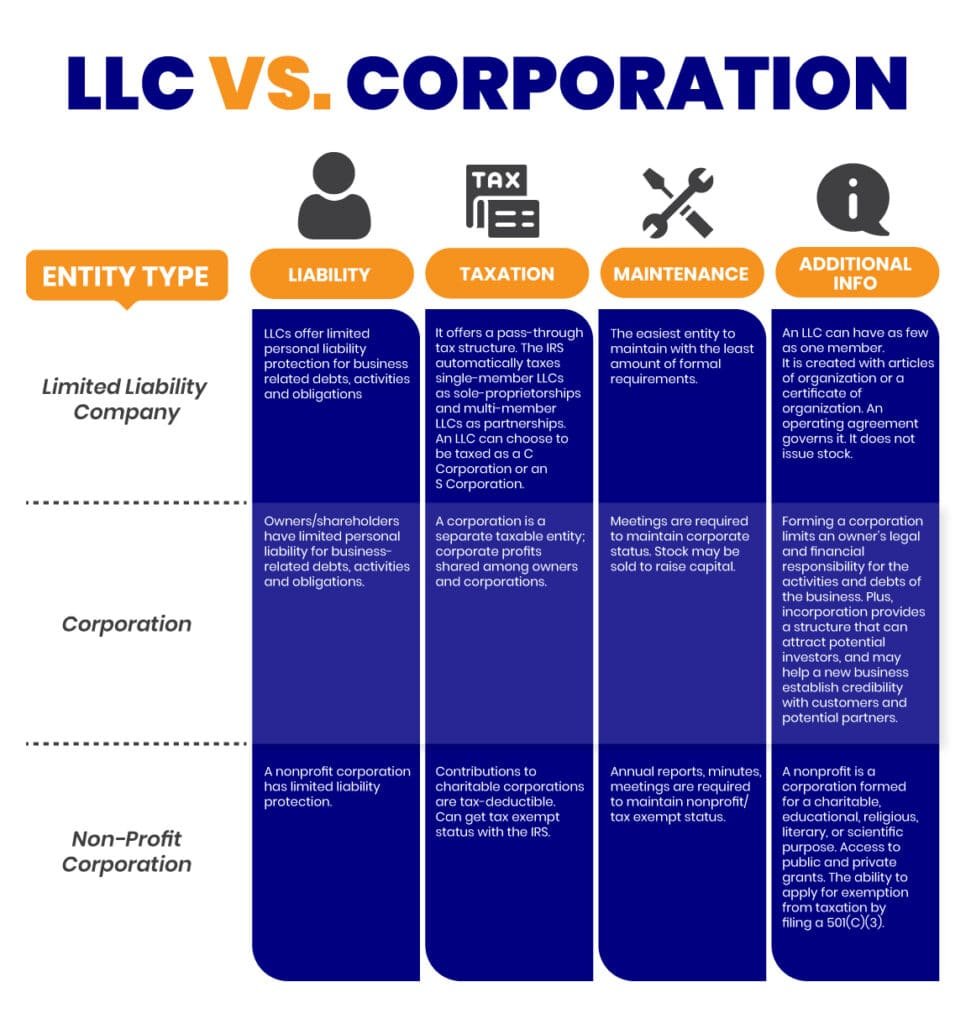

What’s the difference between an LLC & a corporation?

LLCs can be more flexible than corporations and require less administrative and record-keeping. LLCs also have useful additional features, such as avoiding double taxation by being passthrough entities. Small businesses often find LLCs most suitable. 95% of all new businesses are created as LLCs.

Corporations can confer tax benefits of their own, and they are owned more by shareholders than members. Many business formation services offer both an LLC formation and incorporation service.

What Is an LLC Operating Agreement?

An LLC Operating Agreement allows owners to structure working and financial relationships between co-owners to suit the business.

In an operating agreement, the co-owners should establish each owner’s ownership percentage share in the LLC, their share of profits, their responsibilities and rights, and how an owner leaving will be handled.

The ZenBusiness website explains it this way,

What is an operating agreement and why do I need one?An operating agreement is a document that protects the owner’s personal assets from the actions of the LLC, clearly outlines which actions are acceptable for the business, and creates a succession plan should the owner exit the business.You have full control over how to write your operating agreement, but it’s important to follow standard formats to ensure you protect your interests and support your company as it grows.

Additional benefits of an LLC operating agreement

Avoids some of the default rules of the state where you form your LLCWithout an operating agreement, your LLC will default to some of the standard rules and guidelines set by the state.

Helps secure funding from investors and lendersOperating agreements outline legal and financial details like decision-making authority and how funds are used that can be helpful when trying to secure funding for your business.

LLCs & FAQs

What is A Single-Member LLC?

Single-member LLCs are a viable alternative to establishing your business as a sole proprietorship.

Sole proprietors only work for themselves. As a result, there aren’t any rules or fees applicable to sole proprietorships, although there are a few requirements you need to consider if you want to start hiring employees. Since the proprietor and the business are legally considered the same, such a business structure could place the proprietor’s assets at risk if the business falls into financial woes.

To counter this risk, you can set up a single-member LLC, of which you are the sole owner. This arrangement protects your assets in case the business goes bankrupt.

You can also add the ‘LLC’ term to the name of your business, protect your assets and limit your liabilities if the business fails to make proper payments or has a lawsuit filed against it.

However, this arrangement is not without its disadvantages. You have to register your LLC with state authorities, ensure that your business complies with applicable laws and regulations, and pay the annual LLC registration fees as well.

How Do The Owners of a Single-Member LLC Get Paid?

Owners of single-member LLCs don’t draw a salary or get paid any wages. Instead, they are entitled to withdraw the money in the LLC’s account at their discretion.

The owner of a single-member LLC can simply write a check for themselves or transfer money from their LLC’s account into their account. It’s that simple! It is called ‘Owner’s draw.’

How Are Owners of a Single-Member LLC Taxed?

As per the IRS, a single-member LLC is treated similarly to a sole proprietorship by default. The LLC is not required to pay any income tax. Instead, its profits & losses get passed on to the owner. Your LLC is considered a ‘disregarded entity’ in the eyes of the IRS.

In simple terms, single-member LLC owners don’t need to file any extra federal tax returns. Since they’re the sole owner of the business, the total income earned by the LLC is treated as their income in their tax filings. However, your state might have different tax filing regulations for LLCs. Do go through your state’s laws regarding this subject.

However, owners can also opt for their LLC to get taxed like a corporation. In such cases, the owners are considered to be an employee. They can pay themselves through the LLC’s payroll if they choose to do so.

While this method will lower your self-employment taxes, you’ll also have to spend more time buried in paperwork during tax season. Therefore, we recommend that you consult your accountant to learn more about this route before deciding.

What Exactly Are Online LLC Formation Services?

Online legal service platforms are modern alternatives to traditional law firms. Online legal service websites help you contact independent law practitioners who can provide you with legal services should the need arise. In case you do not wish to engage the services of a personal attorney for your business requirements, these platforms can connect you with qualified experts who can send in your license applications, draft contracts, or submit important documents without charging the exorbitant fees or long-term commitment typically demanded by traditional law firms. These services are useful for people who run small businesses, although these platforms also provide services for handling personal legal issues.

How Much Does It Cost To Get An LLC Formed Online?

Online legal services tend to differ significantly in their pricing, which varies from plan to plan. Each plan comes with a defined set of legal services customized as per one’s business requirements. For instance, plans that include registered agent services tend to be costlier than others. However, it is an important service worth every penny as most businesses require registered agents to carry out their operations legally.

Plans that offer standard limited liability company legal services tend to cost anywhere between $80 to $150 plus the state fee. Incorporation formation plans are sometimes more expensive.

How Do Online Legal Services Work?

It’s a fairly simple process. Once you submit a form detailing the services that you require, a professional will be assigned to your case with whom you can discuss other important details. They will then research, complete & submit the documents on your behalf. Alternatively, they will also provide you with the necessary guidance and template forms if you’d like to handle them yourself. This process may vary depending on what services you’re hiring them for.

However, you will be able to minimize your costs and efforts by opting for online legal services, either by using step-by-step guidance for expediting the process by transferring the task to be handled by an expert.

What Services Do Legal Services Platforms Provide?

Most legal services platforms seek to fulfill the needs of emerging or small businesses. Their services include filing LLCs, filling permit applications, trademark registration, researching bylaws, and drafting contracts.

However, other online legal services platforms also offer support with personal legal issues. They can connect you to experts specializing in subjects like living wills, power of attorney, immigration issues, and mortgage agreements.

LLC vs. Corporation

What Is an S Corp, C Corp, and LLC?

Among the first decisions that an entrepreneur has to make is whether to start an LLC or a C Corp. You may have heard about an S Corporation as well, although it isn’t a separate business type. If you’re looking for information about these business entities, here’s all you need to know:

LLC

Business owners often prefer a limited liability company structure since it insulates them from financial downturns while also providing flexibility regarding management and taxation. An LLC may be taxed as a multi-proprietorship or a sole-proprietorship; however, business owners are exempt from corporate tax, which allows them to safeguard their banking accounts. LLC owners are considered to be self-employed individuals and pay taxes accordingly. However, they are not allowed to issue stocks. Their businesses aren’t eligible for international recognition either. They don’t need to pay double tax, meaning that the CEO only has to shell out for personal taxes – an arrangement that helps them skip complicated paperwork and save precious time.

C Corporation

A corporation happens to be a company that’s also a separate legal entity. The ownership lies with the shareholders, either the founders or other individual investors. It is similar to an LLC in that the business is entirely separate from the shareholders’ assets and personal liabilities. However, shareholders are subject to double taxation since C Corporations are taxed as separate entities.

This means the income gets taxed at both the organizational and investor level. This structure enables businesses to make money or develop international partnerships with the help of investor funds. A corporation needs to have a Board of Directors. They also have more reporting and bookkeeping requirements compared to LLCs.

S Corporation

Small business corporations aren’t actually a separate business type – it only exists for tax classification purposes of the IRS. While businesses are officially either C Corporations or LLCs, some may also be eligible for S Corporation status. To qualify for this, it needs to be a US-based business, has less than one hundred members, and has only a single class of shareholders.

In S Corporations, taxes need not be paid on the profits, thus preventing double taxation for C Corporation shareholders. Taxation only takes place at the individual level. Reporting requirements are also less stringent compared to traditional C Corporations. However, S Corporations are also subject to extra scrutiny from IRS authorities and might not be great for firms looking to attract venture capitalists.

What’s the Best Legal Services Platform for Your Needs?

Firstly, you need to decide how involved you would like to be in your company’s legal affairs. Some platforms provide templates and legal forms that you can fill out on your own. They will also give you the necessary guidance, instructions, and edits needed to approve the documents.

Other legal services will handle the documentation part completely for you. For more important projects requiring extensive field research, like copyright and patent filing, we recommend going for providers who are specialists in their respective fields and aware of the intricacies of the subject at hand. For the first time, people launching a business should seek experts who have a strong understanding of taxation, licensing, local and state laws.

Additionally, you must also ensure that the legal service provider you hire is trustworthy. Regardless of your needs, there’s a high chance that you will be sharing susceptible information regarding your business. It is important to check out the provider’s reputation and reviews. If the company’s website has a professional design, includes legitimate contact information, and has a strong social media presence, it is a sign that it’s a genuine legal service provider.

Is a Legal Services Platform Right for Your Business?

Firstly, legal services sites can help you launch your business properly without making any errors. Legal procedures for LLC formation, permit and license applications, and research into bylaws are all complicated. Legal service sites can help you overcome many hassles that normally stall the entire process and distract your attention from the plan. They can help you avoid accidental legal violations and fines. They are also more affordable compared to personal attorneys. They will take care of all legal documentation requirements, thus helping you focus solely on your business and your vision for it.

How to Protect Your Personal Finances From Business Risks

According to author and attorney Mark Kohler, a writer with Entrepreneur.com, there are some important steps business owners can take to protect personal assets from business risk.

(Please keep in mind, our website does not give legal advice, we are paraphrasing an article from the online magazine Entrepreneur.)

Many small business owners are woefully unaware of how they can protect their personal wealth. Most of them fall prey to expensive asset protection policies, which have a poor track record in delivering when they’re required. Others simply purchase more insurance and hope that they’ll never run into an accident or a lawsuit.

Asset protection deals with protecting the business owner’s personal assets from being exposed to their business liabilities, something that’s dangerous for both the business and its owner.

Mr. Kohler recalled in his article a recent case of his where he had a small business owner client who called him and was worried because one of his customers had fallen while entering his office and broken his arm in the process. However, he had been prepared for such scenarios beforehand, which helped him avoid being sued for personal liability. Had he not opted for such strategies, he could have lost his house or other personal assets in the resulting lawsuit.

Here are 4 strategies Mark Kohler suggested business owners use for protecting their personal wealth in case their business is required to pay damages that threaten to bankrupt it:

- Adopt the right business structure

While sole proprietorships may make sense when you start, it isn’t the best way to go if you want to protect your personal assets from your business liabilities. A sole proprietorship structure means that the owner’s personal assets and wealth, like his properties, investments, and the house, may be used for paying off business liabilities.

Using a limited liability company or LLC structure will give you ample protection if a lawsuit gets filed against you. For instance, my client’s business structure had two layers to it. The business was operated as a corporation, with the building being held by an LLC. As a result, the corporation became the business named in the lawsuit, and the LLC became the entity that owned it. Since there were 2 entities, the customer couldn’t file a suit against my client’s personal assets.

- Keep your personal and business finances separate.

Although you may have set your business up as a separate entity, the documentation alone will not suffice to rescue you from potential lawsuits. Your business must also have a separate bank account. Important documents should only use their name, and the properties should be registered in the company’s name. Additionally, you should also maintain annual minutes in your corporate book.

Don’t think that filing the LLC’s Articles of Association on the official website or via an online incorporation service is all you have to do. You must also possess the documents specified for your business entity structure and follow all applicable annual maintenance procedures. You should hold meetings, maintain minutes, and pay prescribed fees as well. For instance, my client had rock-solid company documents, which confirmed that they complied with all internal and state regulations. This helped us remove the need to create paperwork from scratch.

- Maintain proof that you are a credible business owner

Creditors are notorious for attacking the personal assets of business owners when they are found to have acted fraudulently or negligently. For example, having documents to prove that the business had a snow & ice removal procedure in place and that there were adequate warnings about the entrance being slippery posted for the benefit of his customers. If you prove that you took all steps to ensure your customers weren’t affected adversely, the judge might be inclined to rule in your favor.

- Purchase the right amount of insurance

Don’t go for asset protection policies, especially if they recommend hiding your assets or using an entity to avoid insurance payments. A business cannot survive without insurance coverage, which is an expense that must be accounted for from the beginning. It ensures that your personal assets are never in danger of having to compensate for issues related to your business.

Ensure you purchase the right insurance policy. The best insurance policy for you may differ depending on your own – a retail store, professional practice, or a rental property. For example, someone has two insurance providers – one for his business and the other for his building. Have a comprehensive annual review with your insurance agent and ask him to give his recommendations for the best policies and options that could work in your favor.

Although these were elementary examples, the message is quite clear. The steps mentioned here to protect one’s assets were affordable, straightforward, and simple. It’s probably a good idea to implement these steps earliest and consult a licensed attorney specializing in business planning and asset protection. This will ensure that your personal financial assets are not targeted in case your business goes south.

Sources: Entrepreneur.com

How to Protect Your Assets…, Investopedia

What Are The Best States To Form An LLC??

In general terms, most people will find the best state to form an LLC in the state they reside in, and for most people, this is the state they plan for your business to be based in. This is called a Domestic LLC. If you form an LLC outside of your home state, this is known as a Foreign LLC and requires you to file as a Foreign LLC.

Most business people would agree that the top states with attractive business and tax environments for forming an LLC would include Wyoming, Texas, and Florida.

A popular state to incorporate in is Delaware. Delaware is best suited for corporations that need to sell shares and have access to capital markets. If you live in Delaware or plan to start a business in Delaware, forming an LLC in Delaware is an attractive option.

Visit them online today.

Information on three more formation services can be found in our article Stripe Atlas vs. Clerky vs. Gust Launch.

Note: The information on our website is for general information and educational purposes only. Tax rules and laws often change regarding the location and industry of a business. Top 10 LLC Formation Sites do not offer legal or tax advice. We recommend you find a licensed tax or law professional for assistance on these topics.

The LLC formation services listed on our website are not law firms. They are document filing services.